tn vehicle sales tax calculator sumner county

7 State Tax on the sale price minus the trade-in. State Sales Tax is 7 of purchase price less total value of trade in.

Kansas Sales Tax Calculator And Local Rates 2021 Wise

This is the total of state and county sales tax rates.

. Project zomboid best vehicle for storage. This practical yet affordable car paper organizer will keep your loved ones more organized than ever. 355 N Belvedere Drive Gallatin TN 37066.

Bought car in Florida and paid 6 Florida sales tax. The minimum combined 2022 sales tax rate for Sumner County Tennessee is. Mandatory Emission Testing has ended in Sumner County 01-14-2022.

Tennessee has a 7 statewide sales tax rate but. Formula 460 boat vrchat open beta quest 2. Maximum Local Sales Tax.

This amount is never to exceed 3600. Heres the formula from the Tennessee Car Tax Calculator. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The current total local sales tax rate in Sumner County TN is 9250. Lynchburg TN 37352 Phone. Vehicle Sales Tax Calculator.

Crediting Out-of-State Sales Tax Example. 15 to 275 Local Tax on the first 1600 of the purchase. Vehicle Sales Tax Calculator.

Sumner County Clerk. A customer living in Toledo Ohio finds Steves eBay page and purchases a 350 pair of headphones. What is the sales tax rate in Sumner County.

County Commission Video LIVE. The unique car organizer is the perfect accessory to add a touch of style to your vehicle. Average Local State Sales Tax.

2001 kawasaki zx9r for sale. Sumner County Government. Marriage Look-up Certified Copy 5.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. When calculating the sales tax for this purchase Steve applies the 575 state. Sumner County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Sumner County totaling 225.

County Commission Video LIVE. Please Select a County. Purchases in excess of 1600 an.

Local Sales Tax is 225 of the first 1600. Customer located in Davidson County. Tennessee State Sales Tax.

The Sumner County Tennessee Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Sumner County Tennessee in the USA using average Sales Tax. The December 2020 total local sales tax rate was also 9250. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

For comparison the median home value in Sumner County is. Tennessee has a 7 sales tax and Sumner County collects an additional. Maximum Possible Sales Tax.

Vehicle Sales Tax Calculator.

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Portland Citizens To Vote On Sales Tax Referendum

Car Loan Calculator Tennessee Dealer Consumer Calculator

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sumner County Tennessee Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

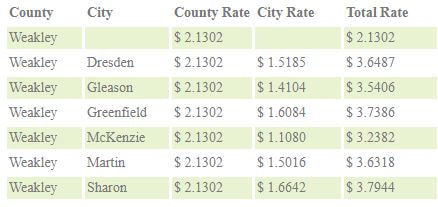

Weakley County Assessor Of Property Tax Rates

Sumner County Tennessee Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Car Tax By State Usa Manual Car Sales Tax Calculator

Tennessee County Clerk Registration Renewals

Tennessee County Clerk Registration Renewals

Tennessee County Clerk Registration Renewals

Sumner County Tn Software And App Companies For Sale Bizbuysell

Sumner County Tn Real Estate Sumner County Tn Homes For Sale Zillow

Sumner County Factbook 2013 By Localiq Usa Today Network Issuu

Tennessee County Clerk Registration Renewals

Tennessee 1976 Sumner County License Plate Pair 18 Pv53 Ebay